For CHECKING: 10-digit account number found on the bottom of your check ( see image)ĭon’t have checks for your checking account and unsure of your account number? For more information please go to our Routing & Account Numbers page.For SAVINGS: simply use your member account number – do not add a suffix or any extra digits before or after TurboTax outages reported in the last 24 hours.WESTconsin Credit Union’s Routing Number: 291880589.When setting up Direct Deposit, electronic payments or electronic tax refunds, you’ll need to know certain numbers pertinent to your account. If you use an invalid or incorrect account number for electronic deposit of your tax refund it may be rejected and then the IRS will issue your tax refund as a check instead of attempting to deposit your funds electronically again. To check the status of your Minnesota tax refund, visit or call (800) 657-3676.To check the status of your Wisconsin tax refund, visit or call (866) 947-7363.To check the status of your federal tax refund, visit irs.gov/refunds or call the IRS’s Refund Hotline at (800) 829-1954.The funds will be deposited on that specific date and are not able to be released early. The date in which funds from a pending deposit are made available in your account is determined by the originating company sending the deposit.Tap menu icon next to ‘Account Statement’.If you do not receive a tax form by February 22, please contact us to request another copy.įor members enrolled in eDocuments, your 10 forms will be available by January 31.If you are unable to retrieve your electronic version of the form, you can stop in or call your local office. If you are enrolled in eDocuments, your tax forms will be available through WESTconsin Online.Dividends earned can be found on your December 2021 statement. If you earned less than $10 in dividends on your accounts in a tax year, you will not receive a 1099 tax form.For a complete list of forms and details visit irs.gov.5498 IRA and 5498-SA HSA contribution forms are mailed out no later than May 31.1099-R (IRA) and 1099-SA (HSA) forms will be mailed no later than January 31.If the mortgage originated in 2019, shows the mortgage principal as of the date of origination. Box 2 shows the outstanding principal on the mortgage as of January 1, 2021.

#Turbotax return pending full

Review the 1098 form for a full explanation by the IRS.

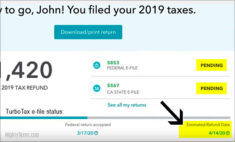

2021 Interest and dividend information is located on the December 2021 statement these can be re-printed for you in any of our offices for $3 Helpful information on accomplishing this is available on our Turbo Real Money Talk online.The IRS filing deadline for federal tax returns is April 15, 2022.Only Primary Account Owner(s) will receive tax forms. 1099-INT tax statements are only mailed to members who earn $10 or more in combined interest during the year.Have questions regarding your tax information? Start here! Many of you may be wondering where your tax refund is after you’ve filed your taxes.

0 kommentar(er)

0 kommentar(er)